The Complete Guide to Buying A Home in Houston, Texas

How to Buy a Home in Houston

Houston is the fourth largest city in America and so moving here can be rather intimidating.

In this article, I’m going to share with you key points to consider when buying your new home in the Houston area. I’ll review the city’s popular areas and neighborhoods, how to match the location with your lifestyle, what to look for when buying your new home and lastly, I’ll review my 10-Step Process to Buying a Home in Houston.

Great, let’s dive into the areas of Houston you may want to consider.

Houston Statistics and Areas

Houston is the fourth largest city and the most culturally diverse city in America. Pretty cool, huh?

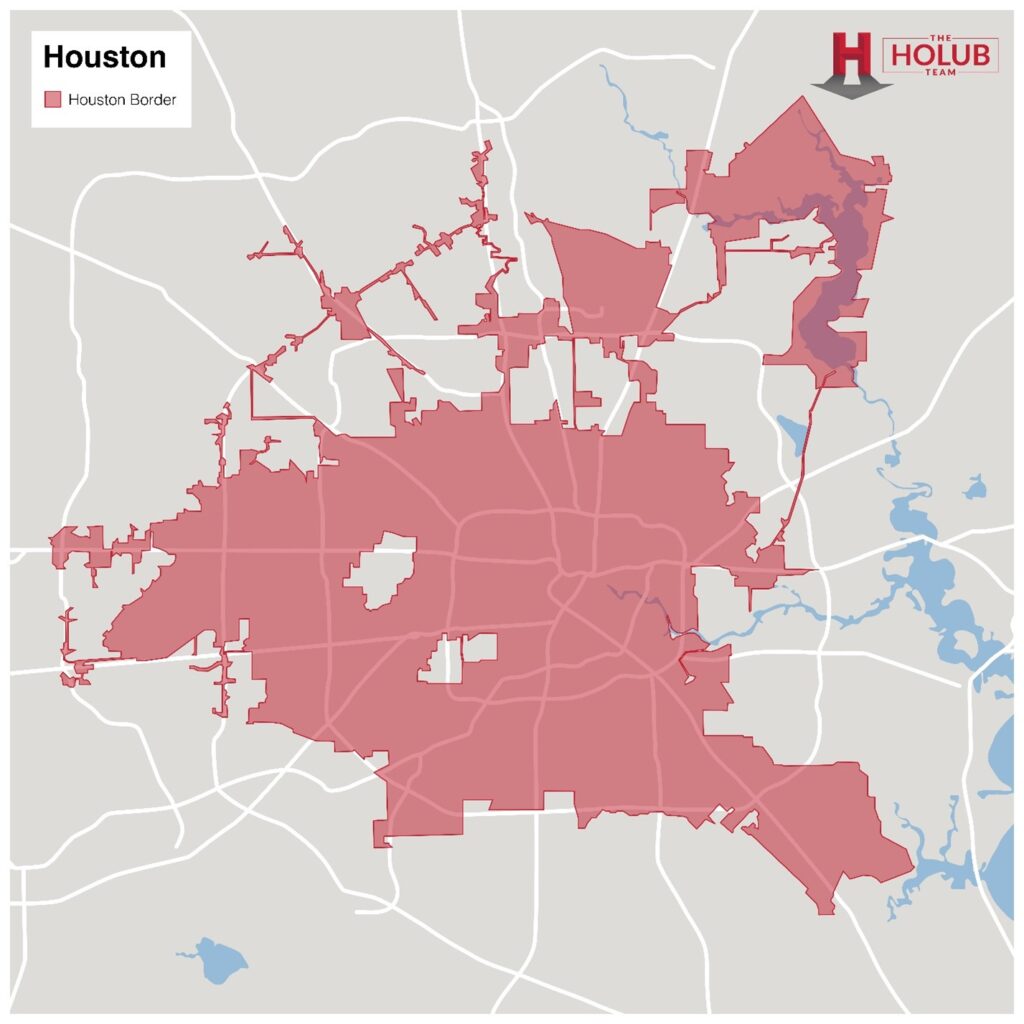

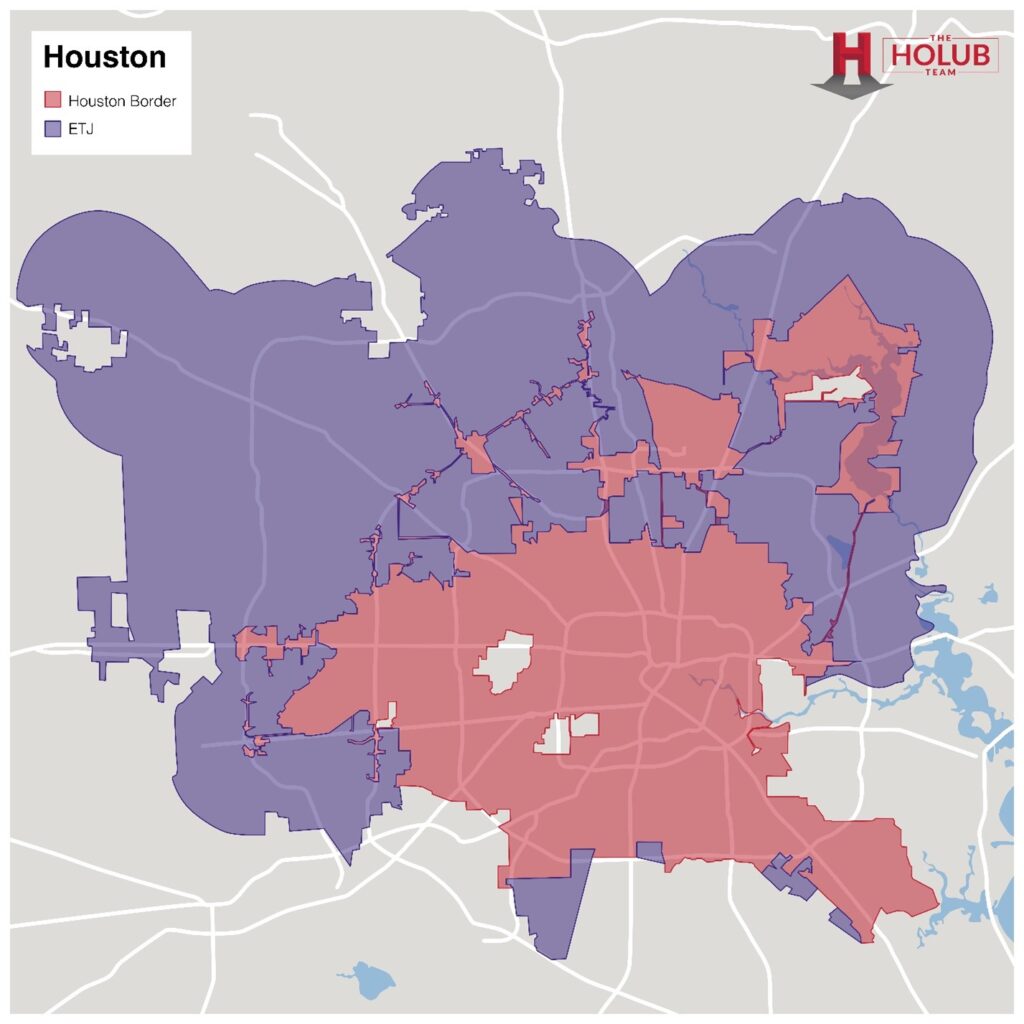

While the actual city limits (map above) look like a child in second grade drew them, for the purposes of this article, I’ll refer to the actual Houston city limits, along with the unincorporated areas as Houston (extraterritorial jurisdiction or the ETJ).

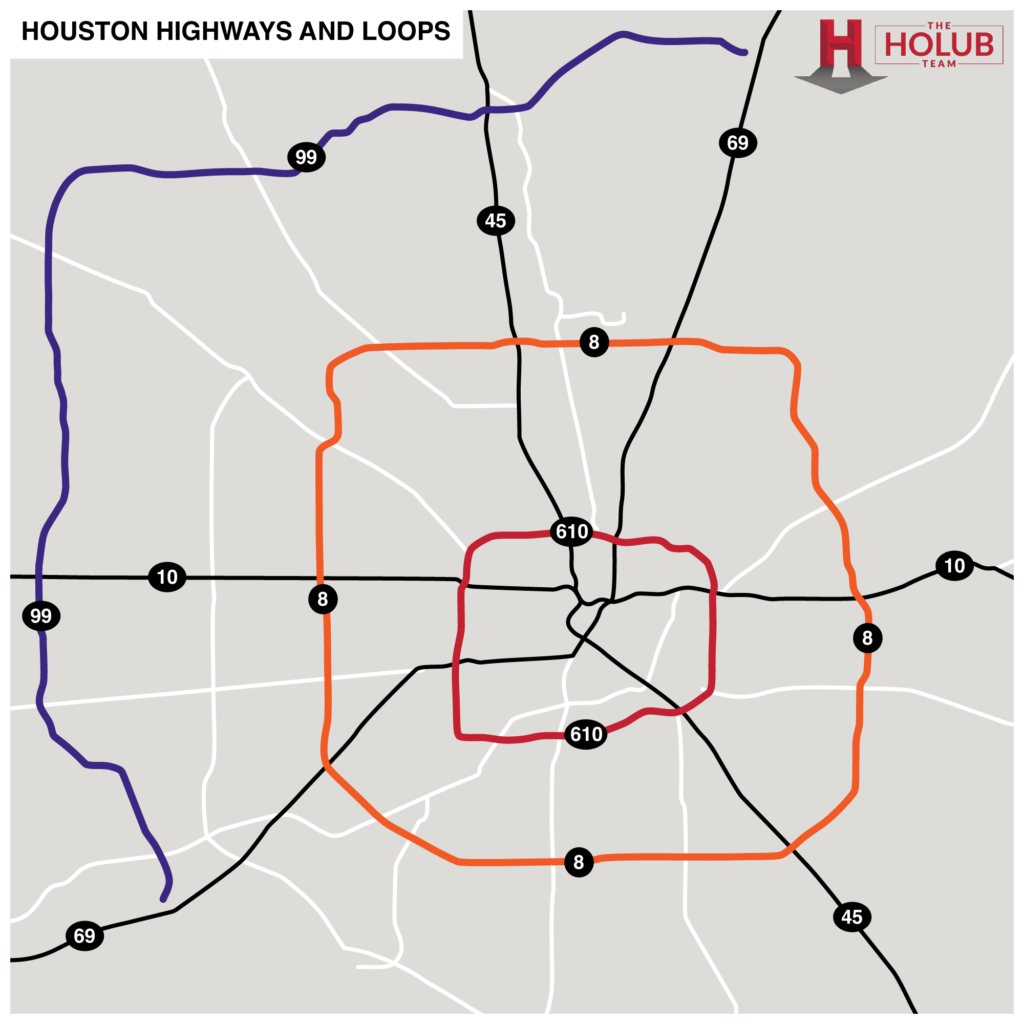

One of the great things about Houston is that there are many great highways connecting the city, offering quick commutes, permitting that traffic isn’t an issue, with the two, almost three, loops around Houston. The inner loop is the 610 loop (commonly referred to as ‘The loop’ by locals), followed by Beltway 8 (the ‘Sam Houston Tollway’), and the third loop is Highway 99 (the ‘Grand Parkway’).

Even with all the great roads, traffic can get pretty hairy around rush hour. Many people say they want to “live in the loop” (the 610 loop) because it’s a short commute to The Galleria and to Downtown, an area that offers renowned restaurants, shops, and events.

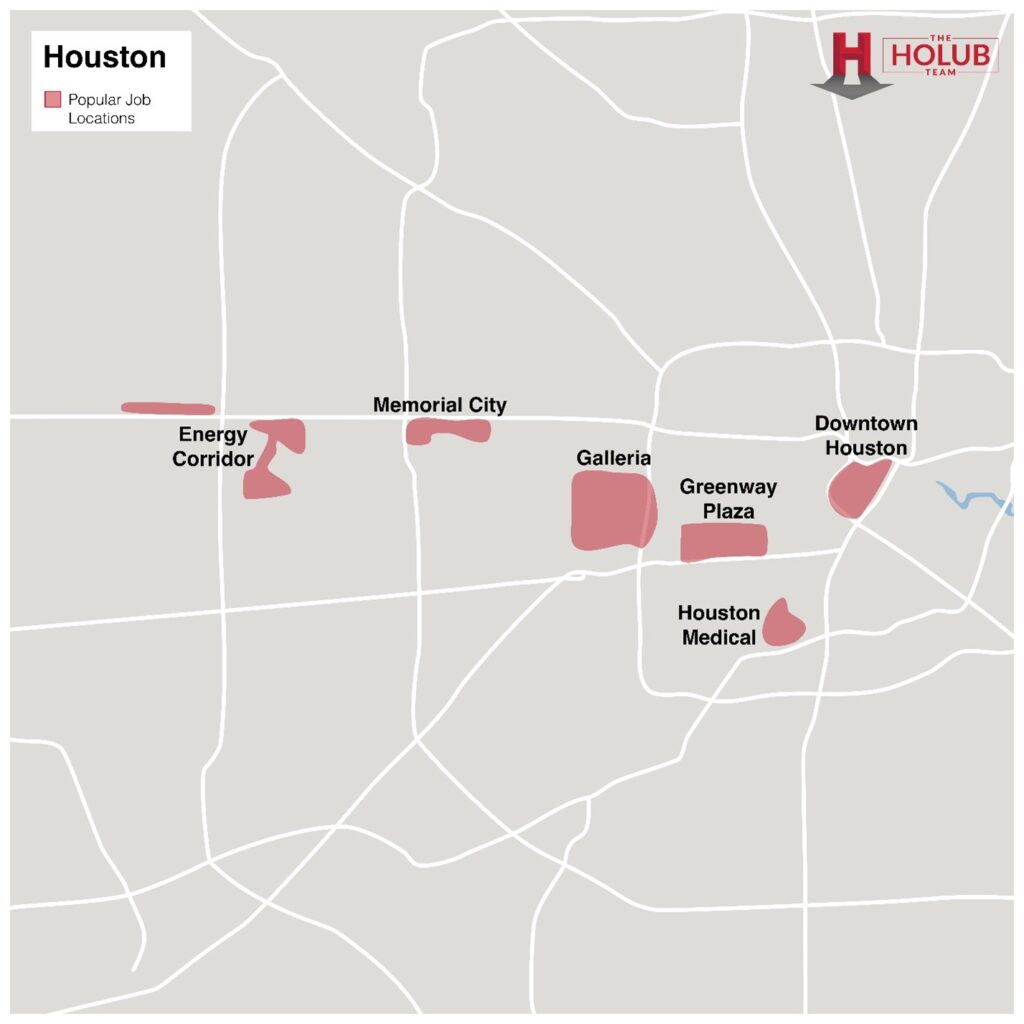

The major business districts are downtown Houston, The Galleria, The Medical Center, Greenway Plaza, The Energy Corridor, and Memorial city. Some business are moving up north to the Woodlands area.

The first step to buying a home in Houston is finding your office location, if you are relocating to Houston and then you will want to determine how long of a commute you’re comfortable with making.

The Houston Association of Realtors has a “drive time” estimator inside their app so you can check out your commute from various times of the day.

Traffic can be a bear in Houston and diving an hour and a half both ways can really take a toll on your happiness. Make sure you take some time to determine if being closer to work in a potentially smaller home is more desirable than a larger home with an hour commute each way.

Surrounding Cities & Areas

Next, you should look at the popular areas and suburbs to see if they are an ideal choice for your commute.

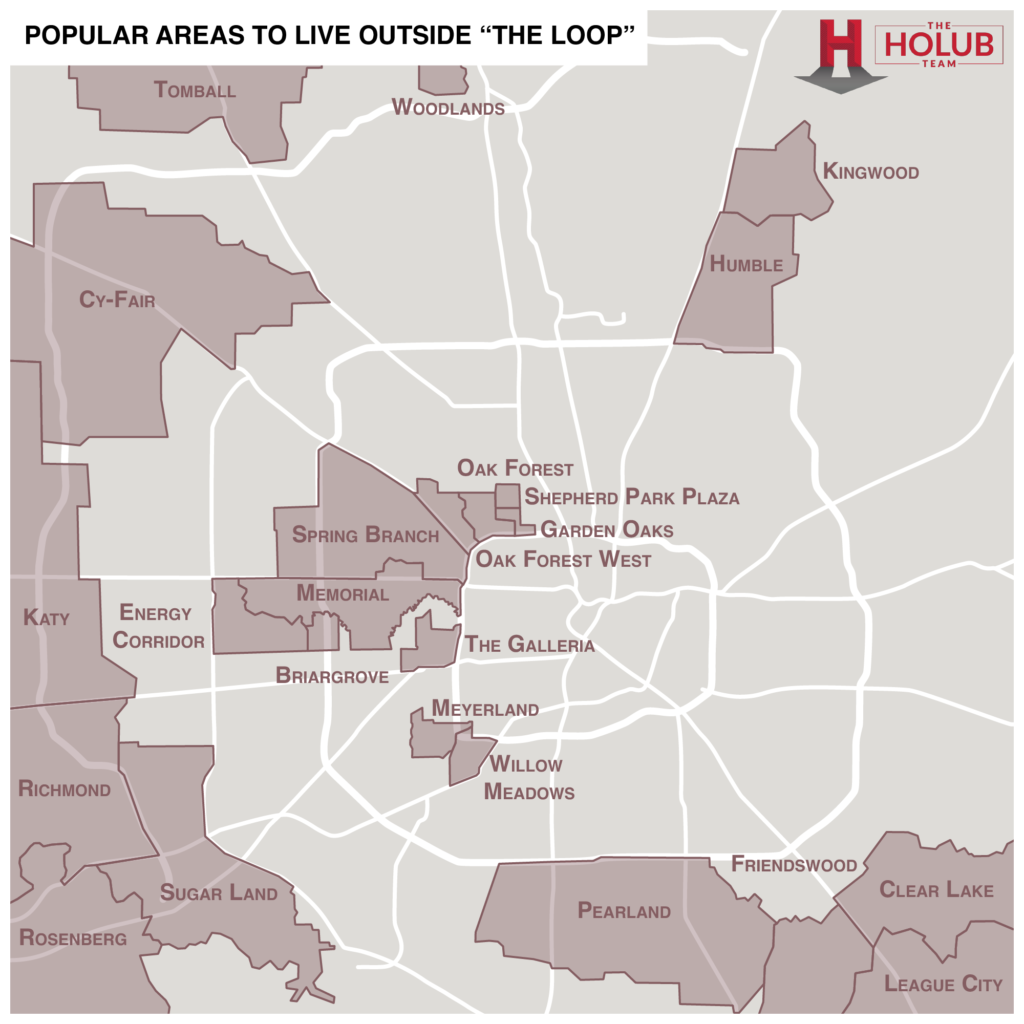

Katy, Energy Corridor, Spring Branch, Cy-Fair, Tomball, Woodlands, Spring, Humble (pronounced after the gentleman’s name “Umble” – I know, we all want to say it as “humble” to be correct), Kingwood, Clear Lake, Pearland, Friendswood, League City, Meyerland, Sugar Land, Richmond, and Rosenburg are just a few of Houston’s popular suburbs.

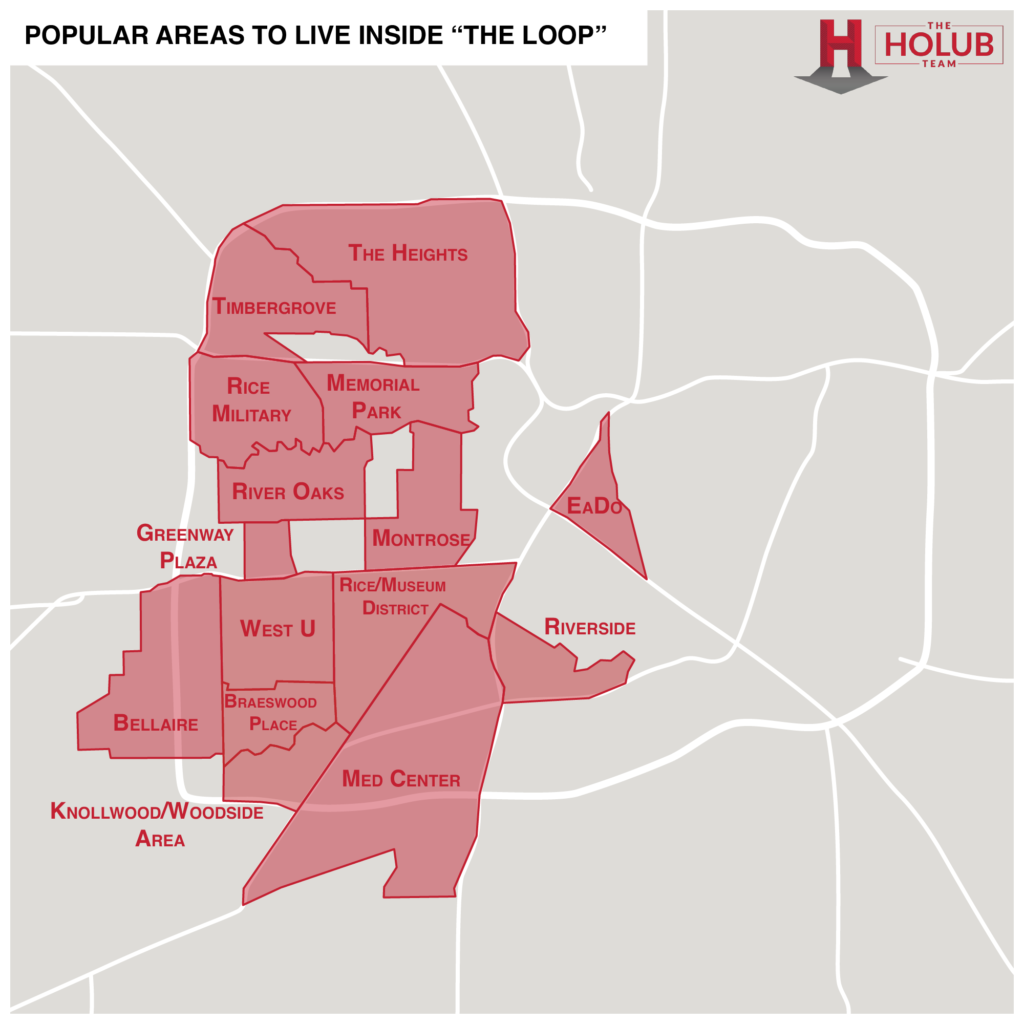

Here are some popular areas inside the loop: The Heights, Rice Military, River Oaks, Memorial Park, Montrose, Greenway Plaza, University Area, Bellaire, the Med Center, EaDo (East Downtown), NoDo (North Downtown), and Timbergrove.

Lifestyle and Areas

Walkable & Trendy Areas

If you are looking for walkable areas, then The Heights, Rice Military, Montrose, Bellaire, The Museum District, The Med Center, Greenway Plaza, and the Galleria are excellent options. These will most likely give you the ability to bike to work, walk to grab a cup of ‘joe’ from a coffee shop, eat at your favorite restaurant, or pick up some last minute groceries at the market.

Developing Areas

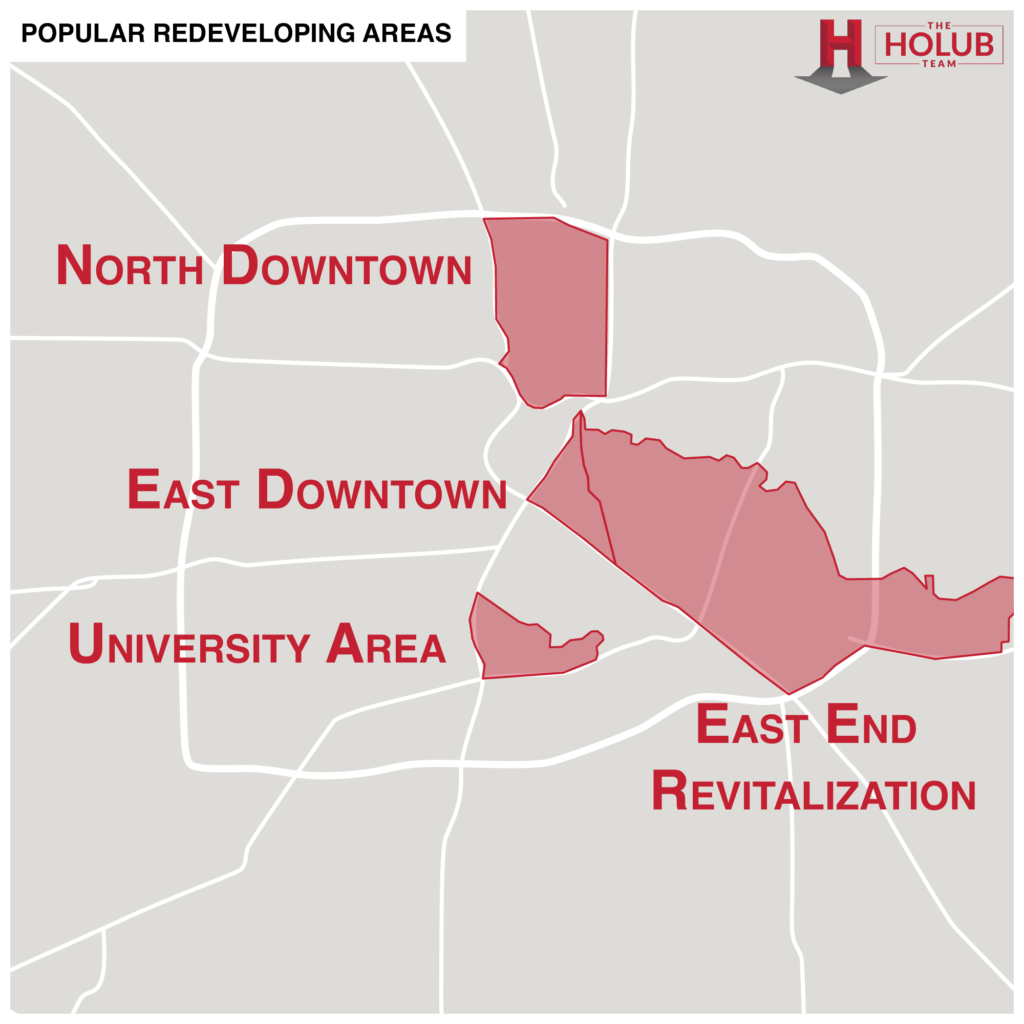

Here are a few areas to look at if you want to get into a redeveloping area: East Downtown (EADO), North Downtown (NODO) and the University Area (around the University of Houston). These areas are bursting with new home construction, remodeling, and available lots for purchase.

Luxury Areas in Houston

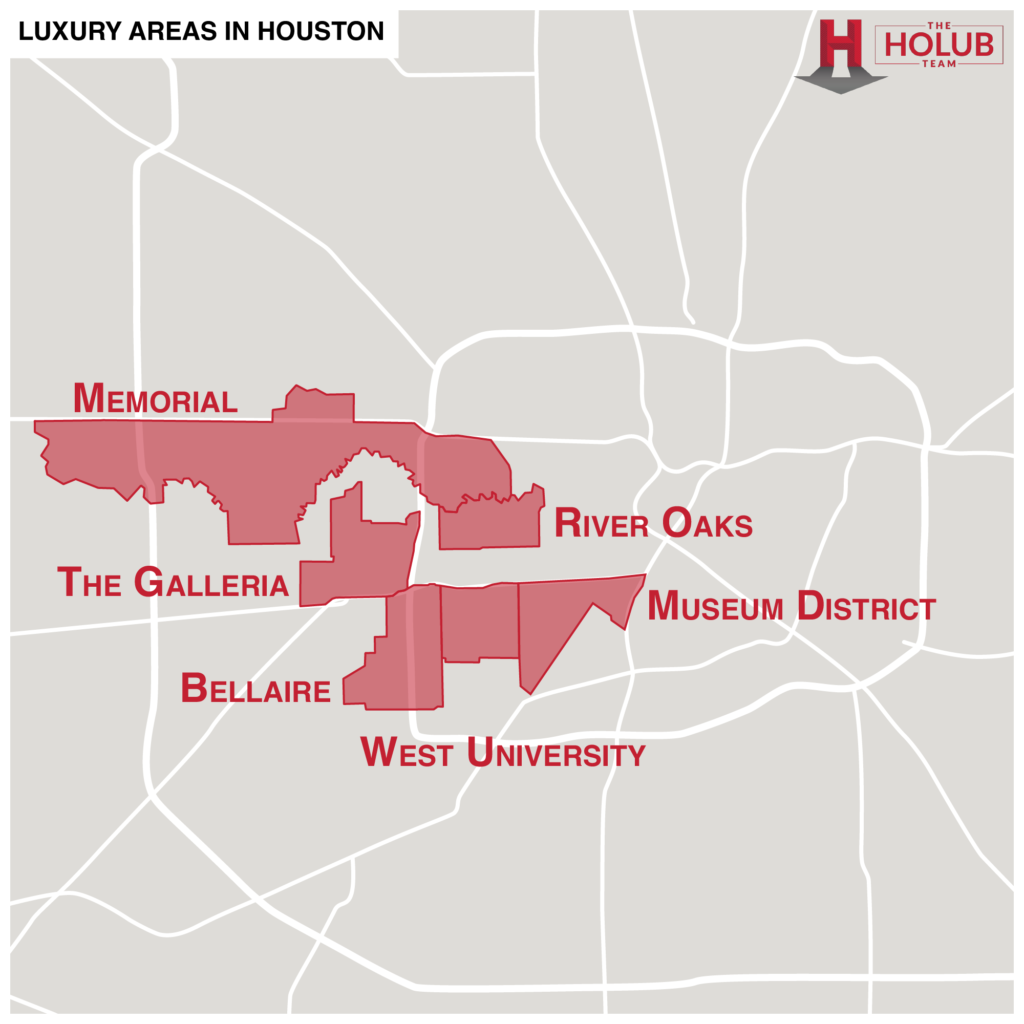

Luxury homes in Houston are defined by any home priced above $750,000. A few popular neighborhoods include River Oaks, Bellaire, West University (or West U), Memorial, and The Galleria.

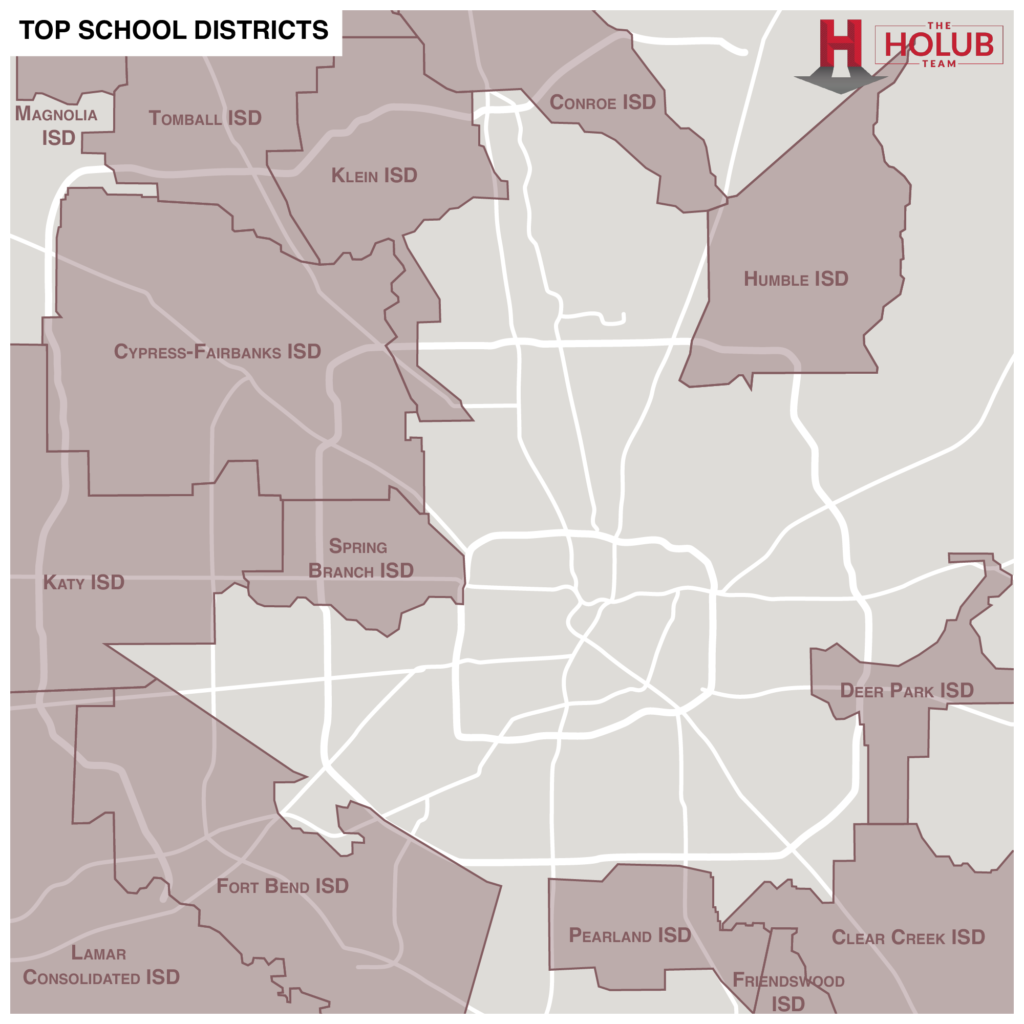

Areas with Top Rated Schools

There are numerous great websites to check out local school ratings. The Houston Association of Realtors has a great database: https://www.har.com/school and I really enjoy https://www.greatschools.org for finding school ratings and reviews.

Regardless of whether you have children, you need to know the school district and the schools your new home is zoned in. If you’re asking why, it’s because a home in a good school district, but zoned to the “wrong” school, may not appreciate like a home on the next street that’s zoned for a top-rated school.

Be sure to research school ratings, and I recommend speaking with other parents with children in your preferred schools to get the inside scoop.

Weather

Let’s focus on the good first: Houston has wonderful mild winters, enjoyable spring-times, and ample rain throughout the year to allow you to grow a garden and other plants. Winters tend to be ideal with a few cold days that may break 32 °F, but it warms up quickly after a day or two.

I remember a few years during the holidays where I was wearing shorts and flip flops because the weather was in the 80s. So, no shoveling snow here!

Spring is my favorite time of the year because we have cooler days and the humidity is often low, and is just inviting you to spend as much time outside as you can from March to early June.

We do get ample rain with an average of 51 inches per year.

Okay, let’s talk about some of the weather related challenges with living in Houston. With the amount of rain we receive, we have a fair number of thunderstorms that move through the area. As you can imagine, the storms make traffic heavier, so you’ll want to make sure to leave earlier if you’re making a work commute.

Another challenge is that Houston does get hot and humid. Being so close to the Gulf of Mexico, along with the ample rain we receive, we often produce 100% humidity days. To combat this, everyone relies on air conditioning, bolting from the air-conditioned house, to the air-conditioned car, to the air-conditioned office. I always try to spend more time outside in the early morning or late evening, just before the sun goes down, because the humidity is lower and we tend to have a breeze in the evenings.

Sometimes we will have a hurricane or a tropical storm that will hit Houston, toting a ton of rain. For example, Hurricane Harvey dumped 51” of water within three days, and with that amount of water in one area, most places in the U.S. would have flooded like we did. Due to this, it’s essential to purchase flood insurance for your home in Houston. Be sure to check the elevation of your house and review the flood maps prior to purchasing.

Some homeowners have installed backup generators, or even mobile generators, to keep their refrigerator running in the event of an extended power outage.

Summer is hot and routinely gets up to the upper 90s and sometimes 100°F. Make sure you have a private, or community, pool you can escape to because you will want it during the dog days of summer.

Taxes

Texas does not have a state income tax. Instead, we have an 8% sales tax and a higher property tax. Most of the City of Houston has an annual property tax of around 2.6%, but newly developed areas see property taxes between 3-4%.

There are certainly ways to reduce the property taxes you pay, however. For example, you will have the option of applying for a homestead exemption which will drop your property taxes by 20%, along with capping any rise in assessed property value by 10%.

Deed Restrictions, Homeowners Associations and Zoning

Unlike many cities in the country, Houston does not have zoning laws, meaning, the city codes do not address land use. So, you may see a new set of townhomes built next to residential homes built next to office buildings and restaurants.

Land is set up for the “highest and best use” by either commercial or residential, depending on its location. Most of the varied land use is within and around the 610 loop.

Because of this, homeowner associations (HOAs) can be important and helpful to retain property values. Almost every suburb has an HOA, and I see them as a positive for homeowners. You will have more restrictions on what you can and cannot do with your property, and you tend to get a few controlling personalities on the HOA board, but in general, I would suggest them for most buyers because they help to maintain property values.

Look Out For These Common Issues When Buying Your Houston Home

Flooding

Anytime you buy a home in Houston, you need to check the flood maps. It also helps to talk with neighbors about any previous flooding events and to chat with your insurance agent about a property’s previous insurance claims (ask about a home’s C.L.U.E. Report).

I always recommend purchasing flood insurance even if your home is not in a flood plain. 1) Just because it didn’t flood in the past doesn’t mean it won’t flood in future storms 2) If FEMA does decide to designate your home as a flood plain in the future, you would most likely be grandfathered in at the lower rate 3) After seeing the mess Harvey caused on so many people’s lives and the additional pain they had to endure because they didn’t have flood insurance, I always recommend getting it.

Foundation

Much of Houston has a clay-based soil that will expand and contract with the moisture levels. We joke that there are only two types of homes in Houston: the homes that have foundation repairs and those that will have foundation repair.

It’s difficult to escape fully as even some newer homes have foundation issues, but don’t fret! Most foundation repairs can be addressed for less than $5,0000, and most homes will only have minor settling over time.

There are homes that do need $20,000 of work or more, so it is good to be aware of what you are getting into, but don’t just run from a house because it had previous foundation repairs. Those are often the ones you actually want to buy!

A few quick foundation tips: know what to look for when you are touring homes, if you are worried about foundation movement then you should have a structural engineer measure and evaluate the foundation during the inspection period, and transfer any previous foundation work within 30 days of taking ownership.

Plumbing

Some homes built in Houston in the 70’s and prior have galvanized pipes. Overtime, the minerals in our water will wear away portions of the pipe and cause it to leak.

That is why you may see some homes with multiple ceiling repairs (other leaks are always possible). The galvanized pipe may have a small pinhole leak and then sediment may block it back up before it opens up again in the same or another different location.

If the home’s under-slab pipes are original from the 1970’s and older, I would suggest having the pipes tested with a hydrostatic test or even a camera inspection of the pipes. This is helpful to determine if they are in good working order. Tree roots can often find their way into the pipes and cause major damage. Completely replacing the under-slab plumbing can easily cost $10,000 or more, so do not skip out on inspecting the plumbing system, especially if you purchase an older home.

Electrical

Electrical codes seem to change with the wind and so many electrical systems will not be up to code. After an inspection, a seller is not required to bring an older system up to code unless they complete repairs to an existing electrical system.

One example of an item often called out on an inspection report is the use of arc fault breakers. This is a newer code requiring arc fault breakers to prevent electricity from arcing from one breaker to another. I’ve heard from electricians that it is a less common occurrence.

Most homes do not have these and replacing all the breakers can be rather expensive, so it often is noted in the inspection and buyers often decide not to pursue replacing them. I would highly encourage you to speak with an electrician to better understand any potential concerns with the electrical system.

One thing I highly recommend is to replace any Federal Pacific electrical panels. This brand has been known nationally to cause fires, so it is often something I look for when touring homes. I would encourage you to have the seller provide concession so you can correctly replace the electrical box after closing.

Another thing to be aware of is Aluminum wiring. Aluminum will expand and contract more than copper wiring and issues can be caused from expansion and contraction. It usually does not need to be fully re-wired, but all the outlets do need to be mitigated along with work on the electrical box. Be sure to have an electrician review.

These are obviously major items to be aware of, but don’t let it stop you from buying an older home in a great neighborhood. Especially one that has been beautifully maintained. Use this info to discuss with qualified professionals to give you a better understanding of the home’s condition.

Now, lets talk about the step by step process to buy your new Houston home.

Home Buying Process

Check out the infographic below to get a quick idea of the process of buying a home in Houston.

I also have a more detailed checklist that is laminated so you are able to cross off things as they are completed. The checklist also lists referrals for lenders, inspectors, and contractors, along with some other great info. If you’re interested, click here to sign up for the full Home Buying Kit, and I’ll either mail or email you a copy.

10 Steps to Buying A Home In Houston

Step 1: Apply & Receive A Pre-Approval For Your Loan (unless purchasing with cash)

Step 2: Narrow Down Your Preferred Locations and Create A List of your “Must Haves” and “Nice to Have” Features

Step 3: Meet With A Professional Real Estate Agent (video conference for those relocating from out of state)

Step 4: Search for Homes On HAR.com & Begin In-Person Tours or Virtual Tours

Step 5: Place An Offer On Your Favorite House, Negotiate & Execute The Contract

Step 6: Drop Off The Option and Earnest Money (Time Sensitive)

Step 7: Home Inspection & Renegotiate With The Seller If There Are Issues

Step 8: Appraisal & Survey

Step 9: Prepare for Closing

Step 10: Conduct A Final Walk-Through & Sign Closing Papers At The Title Company

Step 1: Apply & Receive Pre-Approval For A Loan (unless purchasing with cash)

Getting approved for a loan is the first step in your home buying journey as it will help you determine what you can afford. Be sure to talk with some professional lenders that have the heart of a teacher; they will walk you through the process and answer all of your questions (send me a quick message and I’ll email for our top lending referrals).

I have worked with some buyers who waited to get approved for a loan after we began our home search. When we found the perfect home, they finished their approval, and it unfortunately came back much less than the list price of the house they wanted. They were heartbroken, and it was difficult adjusting to the homes in their new price range. Don’t let that happen to you; get approved for a loan prior to starting your home search!

It’s a good idea to get a quote from your bank and a credit union. Just be aware that even though you may have been with your “big bank” forever, it doesn’t mean the loan approval process will be faster or easier.

I always recommend a loan officer or lender over a large bank as they will be with you from start to finish, and are much easier to get ahold of.

The bigger banks have improved the speed of their lending, but for the best customer service, I recommend working with a professional loan officer. This is someone you can call on the phone for all your questions or if an issue arises, rather than being transferred from department to department for someone who knows anything about your loan.

Be aware that the bank will almost always approve you for the maximum amount, but just because you are approved for it, doesn’t mean you should purchase a home at that price. Instead, talk with them about what your monthly payment will be to see if it will fit in with your monthly budget.

Should You Just Select Your Lender Based on their Quoted Interest Rate?

It’s important to compare interest rate quotes, but you should not just select your lender based solely upon their quoted interest rate. Oftentimes, a lender will quote you their lowest interest rate but with multiple “points” rolled in.

A “point” is one percentage of the loan amount added on as a fee.

If you want a lower interest rate, then you can “buy down” the rate by increasing the points. You can also lower the upfront cost of your loan by raising your interest rate as it will lower the amount of lender fees you will pay at closing.

Another thing to look for when comparing quotes and selecting a lender is the fees they charge. The largest of fees is the loan origination charge, which tends to come out to $1,400 to $1,800, depending on the loan amount.

Some lenders will break these charges up and some will leave them as a lump sum.

What to look for in a lender:

- Communication – It does you no good to have a lender with the lowest interest rate but will not call you back. Large banks will often pass you from one department to the next as the loan progresses.

- Speed & Timeliness – Ask the lender what their average time is to close a loan and what is the fastest they can close.

- Competitive Interest Rates – This is obviously very important and will impact your monthly payment for years to come, but remember rates change daily and you won’t lock in your rate until the first week that you have an accepted contract.

- Loan Origination Fees – Many lenders tend to be in the same range with their fees but if you see a really great interest rate, make sure you know their loan origination fees and other related costs.

- Cost of Points – You can buy down your interest rate or even get paid money from your lender to accept a higher interest rate if you need a little additional cash.

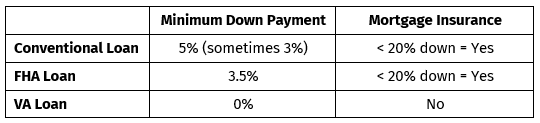

Loan Types

The main conforming loans are: conventional loan, FHA loan (Federal Housing Administration), and a VA loan (Veteran Affairs). They are known as “conforming loans” because the borrower (you) must meet certain standards for the lender that match up the government’s specifications.

These three are the most common loans used, but there are a number of other great options available. We used a Fannie Mae product that allowed us to purchase our home and roll in the repairs and updates into the total loan. It had a higher interest rate and was a little more expensive, but it allowed us to buy a foreclosure and update it to our liking.

Check with your lender and various banks to see if there is a different product that may work best for you. I know a few credit unions that will do a 0% down loan for well-qualified buyers. I don’t recommend that, but it’s good to know about various options.

Closing Costs & Monthly Payments

In addition to your down payment, you will have additional costs to be paid at closing, hence the name, “closing costs.”

Every buyer’s closing costs are going to be different because there are multiple variables that will affect the amount you pay.

Here is a great video I put together to discuss the various fees that go into determining your closing costs.

Pre-Approval Letter

It’s important to get a pre-approval letter from a lender at this point in the home buying process. The pre-approval letter will be used when you make an offer on a home as it shows the seller that you have the financial means to purchase their home.

Getting approved for a loan can feel like you are getting a financial colonoscopy because they want to see two recent tax returns, a few recent bank statements, paystubs, they will want you to source any large deposits, oh and they will run your credit a few times to make sure it hasn’t changed throughout the process.

It’s not fun, but worth it in the end to get into your new home.

At this point, you do not have to commit to a lender or bank, but I would recommend narrowing down your options as much as possible. After getting your pre-approval letter, we can start focusing on finding the right house.

Step 2: Narrow Down Your Preferred Locations and Create A List of your “Must Haves” and “Nice to Have” Features

Everyone wants a 3,000 square foot home on one acre that is walkable to restaurants and grocery stores while having only a five minute commute to downtown – and for only $300,000. I hate to burst your bubble – it’s simply not going to happen.

“You can’t always get what you want, but if you try sometimes…

you get what you need” -The Rolling Stones

I find that most of my clients can get the 3-5 amenities they “must have.” Common “must haves” include four bedrooms, a study, a pool, a 30 minute commute or less to work, a game room, a two story with the master bedroom downstairs, and so on.

Then I will shoot for as many “wants” as I can. This would include a covered back patio, media room, gas appliances, a north facing home, a particular flooring or countertop, on a cul-de-sac, and so on.

The hard part is determining what is a “want” and what is a “need.”

The PDF above will you a good basis as to what’s the most important in your new home, but I find that getting out and touring homes is the best way to hone-in on what’s truly important. When you’re out and about, you’ll begin to have conversations with your spouse about each home, and what you like and don’t like about each of them.

You begin to imagine yourself living in the houses and what that would be like. Would a three bedroom and a study work? Or do you actually need that fourth bedroom? How big of a yard do you actually need or want to mow? Is the game room now a “need” to provide the kids a place to call their own and to contain the ever-increasing amount of toys?

Creating a list of “wants” and “needs” is very important and will help to seer the search for your new home, but at the end of the day, your heart may override your logic.

Let me explain.

I’ve had multiple clients tell me they wanted a two story home, no pool, and it had to have four bedrooms. So, what did they buy? A one story home with a pool and only three bedrooms… to be fair it did have a study.

They bought it because they walked in and fell in love with it. They saw themselves living there, and it just “felt right.”

Step 2 is about clarifying your needs versus wants, but at the end of the day, a home will often reveal itself to be “the one” for you. Next, it’s time for us to meet and begin your home search.

Step 3: Meet With A Professional Real Estate Agent (Video Conference for those Relocating from Out of State)

As a professional real estate agent, I highly recommend meeting with a professional real estate agent. It’s a little self-serving, but let me explain why:

According to the National Association of Realtors, 89% of homes in 2019 were purchased through a real estate agent.

At the real estate consultation, we discuss your goals, timeframe, price point, and your family’s goals with buying a new home to better help find the perfect fit.

Real estate has changed dramatically with online home listings. Decades ago, most of the agent’s job was to network to find great homes for their clients. With HAR.com, and various other housing websites, almost all homes are accessible online, and are the same homes we have access to (except for homes that have not hit the market yet).

So, the great news is that many home buyers end up finding their home through an online search (50% of home buyers found the home they purchased online. NAR 2018) -Cite

Now, back to the home buying consultation.

It’s important to go over the home buying process and make sure that you have a general understanding of what to expect. The process can be a little confusing, so I created a simple step-by-step checklist that allows you to cross off each milestone in the home buying process. You can get a copy when we meet for our home buying consultation, or you can get a copy by signing up here:

Get Home Buying Kit Here

I always discuss and review a sample closing cost sheet that covers estimated monthly payments, closing costs, and provides a breakdown at various interest rates during my initial consultation.

Finally, I like to learn more about your expectations in regard to when you want to tour houses, how you prefer to be contacted, and the best days or times to go on our home tours.

Now that you have a pre-approval letter and a great agent on your side, the next step is to begin looking at homes.

Step 4: Search for Homes On HAR.com & Begin In-Person Tours or Virtual Tours

This is the fun part! Before we jump in the car and tour homes, however, I always recommend scouting out different neighborhoods prior to scheduling an appointment. If you’re new to the area, this is important as you’re most likely unfamiliar with the area. You may drive in and see there are too many cars parked in the street for your liking, or that you don’t like how close the homes are to each other or that you don’t actually care for the location. Whatever it is, it is good to scout the various neighborhoods to narrow down to the ones that you actually want to live in.

Buying a home is not a process of selection, it’s a process of elimination. By that, I mean that you start with eliminating the areas you don’t want to live in in order to narrow down the areas that you do.

By following this process, you will be more informed, less stressed, and generally, find a great home in a shorter period of time. The alternative has you seeing any and every home that could work, but may be too far from work, or the floorplan isn’t ideal, or you may not be in love with the area. All of these things can leave you feeling frantic and stressed out.

How Long Does it Take to Find a Home?

There is no set timeframe for Step 4. Most buyers I work with tend to find a house in 1-3 months after starting to tour homes. Then, it can take 30-45 days to close on your new home.

How Many Homes Do You Typically Tour Before Most People Find the Right One?

Again, there is no set number, but I think it ranges from 5-15 homes. I had one buyer see 74 homes over the span of a year in a half only to decide to rent a home, but hey, it happens!

Tour Homes

When you want to see a home, we will work out a convenient time for us to tour together. I like to see multiple homes to be as efficient as possible, but usually no more than five or six homes at a time.

After seeing multiple homes in a short period of time, you’ll be exhausted, and every home will seem as though it’s running together with the next. Clients coming from another town must see as many homes as they can, so I will often work in breaks for meals and to rest in order to prevent burnout.

When touring homes, you will be looking at the features, updates, and the layout while I will be pointing out potential concerns such as foundation movement, aging roof, previous leaks, older air conditioning unit and so on. I’m not a professional inspector, but after attending so many home inspections, I have learned key things to look out for.

After each home tour, I ask each spouse what they would rate the home 1-10 (with 10 being the best). Anything rated six or less is removed because you shouldn’t settle for something you only “kind of” like. I want you to love your home and be excited to move in!

This is also a great exercise because it helps the couple determine what’s important to each other.

Why did he give the home a nine while she gave it a six? When they see the differentiation, they’ll be more likely to have a discussion to help clarify what they both like.

Once we have found the perfect home, it’s time to make an offer!

Step 5: Place An Offer On Your Favorite House, Negotiate & Execute The Contract

Your home buying journey is about to get real. Up until this point, you’ve only dreamed about buying your new home. Now, the rubber meets the road, and you must make a commitment in the form of a written offer.

There are numerous terms you can change with your offer, but the most important items are:

- Purchase Price

- Closing Date

- Seller Concessions (This is a specific number the seller agrees to provide at closing to lower your closing costs. Depending on the loan type, this tops out between 3-6% of the purchase price)

- Who Will Pay For The Title Policy

- Option Period Length (Inspection Period)

- Earnest and Option Money Amount

- Repairs

- Length of Finance Contingency

- Non-Realty Items (Items not permanently attached to the wall such as the washer, dryer, refrigerator, patio furniture, etc.)

- Contingency of the Sale of Your House (If applicable)

How do you determine what price to offer?

I will run a market analysis to provide guidance in determining what an appropriate offer will be. A market analysis is a review of similar homes that have sold in the past 3-6 months (sometimes a year) to help determine the value of the home.

It’s difficult to compare apples to apples when comparing multiple homes to each other. Some have different upgrades, features, layouts, smells (yes, it makes a difference), but it provides a basis to justify your offer price to the seller and eventually the appraiser.

Next, I’ll send you an email with a link to the contract to review and sign through our online contract system. For first time buyers, I like to walk through the offer together to highlight the major terms and contingencies.

Once everything is signed, I present it to the listing agent with your pre-approval letter for the seller to review.

It’s common to negotiate back and forth a few times to get the right terms, however, some homeowners are just unreasonable, and it’s not uncommon for you to have to walk away if you can’t come to an agreement.

The “walk away” is your strongest negotiating tactic. If you are unable to get the price and terms you want, are you willing to walk away from the home?

The walk away doesn’t work in low inventory markets, so be sure to talk with your agent about the speed of the market and if the market is currently favoring buyers or sellers.

I find that most buyers under-estimate how fast the market moves. It usually isn’t until a buyer misses out on a house they’ve been watching for them to truly understand how quickly good homes can sell. I liken it to a moving river; you think you know how fast it’s going from the bank, but it’s when you step in and are instantly surprised at how strong and fast the current really is that you truly know the speed and strength of current.

Back to the contract! One thing that is very helpful is that the promulgated contract for buying a home strongly protects you as the buyer. The seller has a limited number of options to back out of the contract once it is accepted. I’ll discuss this further in Step 6.

When the seller agrees to the terms, both parties must sign the contract and it must be executed on the day the last signatures are collected.

Every home in Texas is sold “as is,” but that doesn’t prevent you from getting an inspection or asking for repairs or concessions. In the next step, it’s up to you and the professionals you hire to assist with determining the true condition of the home.

Step 6: Drop Off Option and Earnest Money (Time Sensitive)

This next phase of the home buying process is the “contract phase.” This is the phase in which you are working toward a successful closing with the terms agreed to in your contract.

The first thing to do is to make sure the earnest money and the option money checks are dropped off within the outlined dates in contract; this is usually three days in Texas, but check with your real estate professional or attorney to confirm.

Ideally, your agent has the two personal checks (wiring the funds may be available as well) in their possession to drop off with listing agent or title company in order to get written confirmation. This is vital! If the two checks are not received by the seller or listing agent within the prescribed time in the contract (three days), then you may not have a valid option period.

This means that you will not be able to back out of the contract during your option period (also known as the inspection period). In the event you do decide to back out, you could lose your earnest money.

The earnest money amount is negotiable, but it is commonly 1% of the sales price and it goes to the title company and is held in an escrow account until closing or until the contract is terminated.

The option money is negotiable as well, but tends to be a few hundred dollars. The option money goes to the seller and gives you the “option” to back out for any reason; this is usually a seven or ten day period. Because we don’t know the full condition of the house until an inspection is complete, the option period allows you, as the buyer, to get to know the condition better without shelling out a lot of money.

There are various other contingencies that allow for you to terminate the contract and receive your earnest money back. Some common contingencies are: the third-party finance contingency, delivery of the HOA info within the prescribed time, an acceptable survey, the appraisal contingency, delivery of the seller’s disclosure within set days in the contract, and so on.

The contact is set up so that you have multiple contingencies to back out.

The seller has a very, very limited scope to which they can back out of the contract. The two common times a seller is able to terminate a contract is from the buyer not depositing the earnest money within three days of the execution date, and if the buyer does not close by the closing date.

Once the contract is signed and executed (executed means that the last signing party places in the date that all parties accepted the terms), the seller has little recourse to terminate the contract. You, the buyer, are in control. (Nice feeling, isn’t it?)

What if the seller receives a higher offer after we have an executed contract?

The good news is that even if a higher offer comes in after all parties have agreed to the terms, the seller is unable to backout and accept the higher offer. They may be less willing to negotiate repairs and concessions but they don’t have the power to cancel the contract unless you as the buyer do not perform.

Now that the checks are dropped off, we can focus on inspecting the home.

Step 7: Order A Home Inspection & Renegotiate With The Seller

Unless you’re an experienced real estate investor or a contractor yourself, I highly, highly, highly recommend getting a home inspection by a professional.

We don’t know what is going on with the AC, foundation, appliances, roof, electrical, and plumbing, so we need a professional to point out any items of concern.

I provide a list of inspectors that we have had a good working experience with, but you always have the option to select your own inspector. I would recommend asking if they provide the following services:

- A walk-through of the property with you after they finish.

- A detailed report within 24-48 hours.

- A foundation measurement (not all inspectors provide but it is super important in Houston).

- An infrared camera to spot any current or past moisture issues along with missing insulation (sometimes an additional charge).

- Pest Inspection

You may have to pay a little more for the inspector to use their infrared camera, but it’s worth it to see what is happening behind the walls.

Next, you will schedule the inspector (for compliance purposes I am unable to select an inspector for you). I recommend getting them to the house as soon as possible as you will need the rest of the option period to get quotes and renegotiate with the seller.

An inspection for a 2,000-3,000 square foot home can cost anywhere from $350-$700, with the price increasing as the home gets larger or with any additional inspection items. Additional inspection items may include a pest inspection (highly recommended since termites are very common in Houston $100 to $150 and it is required for a VA loan), infrared camera, and a plumbing inspection (few inspectors actually do this, so we will need to schedule a plumber).

You can opt for a morning or an afternoon appointment. The morning appointments usually start around 9 am and the afternoon appointments around 1 pm.

The inspector will usually be at the house (depending on the size) for three hours. You’re welcome to be there during that time, but I recommend arriving toward the end so we can all walk through the house to review the inspector’s findings.

After the walk-through, we will talk about some of the major items of concern and put a list together of repairs that need quotes or further investigation.

Roof and HVAC are the most common items that need to be addressed, so we almost always have professionals come to the house anyway. These professionals can just provide a quote, or you can pay them to complete an actual roof and HVAC inspection. They tend to both run around $150, depending on the size of the house; both are extremely useful when renegotiating with the owner.

Finally, the inspector will send the report to you within 24-48 hours.

After Inspection

Now that the inspector has done his job pointing out the concerns, we need to bring in contractors to further assess and quote the repairs.

As I just mentioned previously, roof and air-conditioning contractors are the most common contractors scheduled, but it just depends on what is found in the inspection.

We will often have a general contractor or two out to quote any major remodeling or repair projects. If the home has foundation movement, I usually prefer structural engineers over foundation companies because the foundation professional is incentivized to tell you that you need their services, whereas the structural engineer only wants to be as informative as possible and isn’t tied to the outcome of their findings.

If a home has been found to have galvanized pipes or cast-iron pipes under the foundation, it’s helpful to have the pipes inspected by a plumbing company with a camera or a hydrostatic test.

Again, there are many more contractors that can be hired to further investigate the home and provide their opinion of any possible repairs. The purpose of getting additional opinions is to 1) Better understand the condition of the home prior to purchasing, and 2) to renegotiate with the owner.

Renegotiating

After the inspections, the second round of negotiations begins. Armed with the inspection report and quotes by other contractors, we can use this information to provide a better understanding of the condition of their home and what needs to be addressed.

If we have beaten the seller down dramatically from their listing price, they tend to be less likely to provide further discounts and concessions. However, if the market is hot, and we provided an initial strong offer, the sellers tend to be more willing to work with the findings.

For negotiations, we can ask for a variety of things, but they usually fall into three groups: concessions, change in sale price, or for the seller to complete repairs.

I like to ask for a discount on the sales price, or concessions from the seller, over having them complete any repairs. Concessions provide you a credit at closing, ultimately lowering your closings costs, and allow you to use the remaining funds to address the repairs. This is a better option for most buyers as it does lower costs, but it also gets less sticky than having a seller complete repairs.

If a seller completes a major repair, unless they are using a bid from a contractor you solicited, they most likely will complete a lower-quality repair at the cheapest price. I would rather get you more money to make sure it’s done the right way after closing.

A few tips I’ve learned over the years:

- No Concessions For Older Mechanicals – It’s difficult to receive any concessions for items that are working well, but that are getting close to the end of their average lifespan (ex. Air conditioning systems, roofs, water heaters and so forth).

- Provide Options – Many times I will give the seller the option of fixing a variety of items or just giving the buyer a concession. The purpose is to make the concessions seem like the easier and better alternative.

- Cooperate – A cooperative approach almost always works over a condescending, adversarial tone.

- Always Take Into Account the Seller’s Feelings and Emotions – A seller that has soured from a request can easily get so offended that they forget their common sense and refuse any more negotiations.

- Your Best Tool for Negotiating is Your “Walk Away” Power – Once they realize they may be losing a deal over a few hundred dollars, they tend to be more open to working together.

After we agree to the terms, an amendment with any repairs, concessions, or a price change will be created. You need to have it signed and executed by the last day of your option period, no later than 5 pm. After the end of your option period, you lose your best “walk away” power.

You could still back out after this period and be protected from other contingencies in the contract but this is the most protective of your ability to walk away without losing your earnest money or other remedies pursued by the seller.

Insurance

During the option period, it’s a great idea to start shopping for homeowner’s insurance. Keep in mind, anywhere you live in Houston, you should have flood insurance.

I would also recommend speaking with your insurance agent to see what the cost are for a “C.L.U.E. Report” is. C.L.U.E. stands for Comprehensive Loss Underwriting Exchange; it’s a comprehensive history on any claims filed by the homeowner in the previous year.

It can go without saying, it’s extremely helpful to see what insurance claims have been made, and hopefully the seller has disclosed them. The next section will explain where you can do your own due-diligence to find out more about the property that you are buying.

Updates and Permits

Another way to find great info on major repairs completed on the home is to check the permit record with the city. This is fantastic because you can see what permits were pulled, and when, and if it lines up with what the seller is disclosing.

Understand that homes outside the actual City of Houston and surrounding municipalities are not required to pull permits for updates and remodeling.

Now that the inspections and negotiations have settled, you can relax now and begin the final items on the way to closing on your new home.

Step 8: Order Appraisal & Survey

Let’s start with the appraisal. If you are getting a loan, the lender will almost always require an appraisal. An appraisal is a value estimation of the home you’re purchasing. Most banks will require it as it protects them from lending more than the property is worth.

So, you are paying around $500 to protect the bank… yay!

I understand the need for an appraisal because there are less than scrupulous people out there who’ll get a loan for far more than the property is worth, and then skip town after it has closed.

Unfortunately, and for the most part, an appraiser can ruin a transaction.

Let’s say you are buying a $300,000 home and putting 10% down ($30,000); if the appraisal comes back at $290,000, the bank will only lend on the $290,000 valuation. Nevertheless, you can address the shortage in a few different ways:

- Have the seller lower the sale price to $290,000

- Come up with an additional $10,000

- Split the difference somehow with the seller

- Back out of the contract and receive your earnest money back (in most cases but dependent on the contract)

The most frustrating part of this process is that the appraisal doesn’t usually happen until after the option period as I want to save my clients the $500 if they decide to back out. So, we could get to this point in the process, not be able to reach an agreement with the seller, and have to terminate the contract, making all the money and time spent on inspections and negotiations is wasted.

It’s less common at higher price points to have to back out due to an appraisal because buyers tend to have more cash available, but I work with clients in all ranges of a budget, and sometimes just getting the down payment and closing costs together is a challenge in itself. A difference of even a few thousand dollars can kill a deal, so needless to say, I am not fond of appraisers.

The helpful thing you have going for you is that the seller will be stuck with that particular appraisal. For FHA or VA loans, the appraisal stays in the system for six months and they are not allowed to get a new one, making sellers more motivated to work things out if the appraisal falls short.

Now, on to the survey.

The survey is a drawing of the property’s boundary lines and includes the permanent structures, along with any easements. It’s important to check that your property (or your neighbors’ property) isn’t encroaching on another property.

If you want to build a pool in the future, the survey is critical for determining how large you will be able to build. Usually the last six to twelve feet of a property is reserved for utility easements and you’re permitted to install anything permanent in that area, otherwise a utility company could destroy it in order to access the utilities. And on top of that – they’ll charge you for it!

Along with the survey is the elevation certificate. Sometimes the lender will require you to purchase an elevation certificate with your survey to accurately estimate your flood probability. This is an additional cost, but it’s helpful to measure the distance the house is above sea level.

Step 9: Prepare For Closing

You are almost there! It’s time to get all the details finalized prior to closing.

- Confirm Homeowners & Flood Insurance

- Schedule Movers – Hopefully you’ve already started packing and have scheduled movers, but if not, now is the time to do it. You cannot move into the property until the loan funds and the contract is officially complete. Sometimes things get delayed by the lender’s underwriters, so be aware that there’s a chance for things to be pushed back a day or two.

- Set Up Utilities – Cable, internet, water, gas, and electricity.

- Change of Address with the Post Office

- Schedule Closing at the Title Company – It’s usually preferred to have the closing scheduled for the morning or the early afternoon. That way, the lender can get the documents back in time to approve the funds. If you close later in the day, they may not fund the loan until the following day and you would not be able to move in until then.

- Schedule the Final Walk-Through – This is incredibly important tip that most buyers and agents neglect. Always have a final walk-through! It may have been a few weeks, or even months, since you’ve last seen the house, so you need to make sure there hasn’t been any flooding, fire, or damage since the seller moved out.

- Wrap Up All Final Loan Items:

- Closing Disclosure – This is required to be sent to you from the lender three days prior to closing.

- Settlement Statement – This document is from the title company and will have a breakdown of both party’s debits and credits. Here, you’ll see the final amount of cash necessary to close.

- Ask Seller for Contractor Referrals (optional) – It’s always helpful to have the contact info for a good landscaping crew, plumber, pool maintenance, handy man, maid, and so forth.

Step 10: Conduct A Final Walk-Through & Sign Closing Papers At The Title Company

It’s finally here! Closing day!

As I mentioned previously, you’ll meet me at the house for the final walk-through to make sure your new home is in great shape, the correct appliances and accessories were left, and that everything is as it should be per the contact.

Then, we will head to the title company for the closing. You will need a cashier’s check for the total amount required or have sent it previously by wire (always confirm directly with the title company if you select to wire your funds. Scammers will often email and sometimes call you to tell you that the wiring info for the title company has changes. Always confirm with the title company directly).

You’ll also need a government issued I.D., such as an unexpired driver’s license or passport.

At closing, the escrow officer will direct you where to sign on each document; please be prepared to spend 30 to 60 minutes at the closing table. Rarely will we ever sign with the seller’s present, it just makes it a little awkward.

They will need the seller to sign and if they have done so, the escrow officer will scan the documents to your lender. Once the lender approves, the funds will be released and the transaction is consummated. You’re now the new homeowner!

After Closing

Change You’re Mailing Address

Research Home Warranties

Set up Maintenance Contracts, Including Lawn Care and Cleaning Services